News / Promotion

LHDN E-Invoice Penang, Malaysia 2024

Apr 16, 2024

View Full Size

Choosing Between Accounting Software API’s Integration Or Manual Submission Via MyInvois Portal

Malaysia E-Invoicing

As part of Malaysia’s effort to improve the efficiency of its tax administration management, the Government plans to implement e-Invoice in stages to support the growth of the digital economy. This is in line with the Twelfth Malaysia Plan, which focuses on strengthening infrastructure for digital services and digitizing tax administration.

.png)

Malaysia LHDN aims to enforce mandatory e-Invoicing adoption for 4,000 businesses by August 2024, concerning those with an annual turnover of RM 100 million! Furthermore, starting from July 2025, e-Invoicing will become compulsory for all businesses, regardless of their sales threshold. According to the guidelines provided by the Malaysian Inland Revenue Board (IRB) in version 1.0 of the e-invoice guideline, businesses in Malaysia have two ways to upload and sync their invoices to the government platform:

Adoption of Accounting Software with compliance with IRB Malaysia

One of the ways to comply with the e-Invoicing mandate is by adopting accounting software that is designed to be compatible with the IRB Malaysia API’s (Application Programming Interface) guide. Specifically, businesses can opt for accounting software solutions such as SQL Accounting software, which is certified to meet the IRB’s requirements.

With this method, businesses can streamline the process of e-invoice submission. Once an invoice is issued through the SQL Accounting software, there will be a convenient and straightforward option available to users. By simply clicking a designated button, the invoice can be directly and automatically synced to the government’s e-Invoicing platform. This approach saves time and effort for businesses, ensuring efficient and real-time submission of invoices to the IRB.

Manual Submission to myInvois Portal for Batch Submission

For businesses that do not have or prefer not to use compatible accounting software, the IRB provides an alternative option for manual submission. This method involves utilizing the myInvois portal, which is designated for e-invoice submission manually.

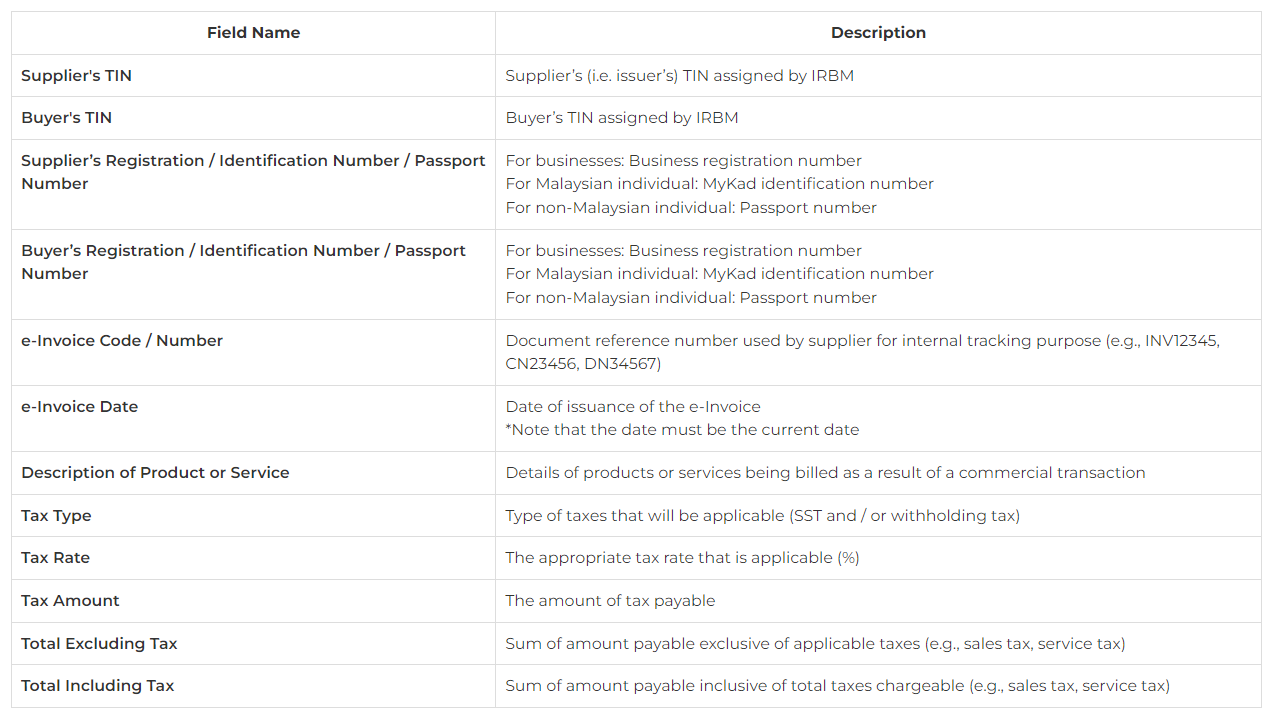

Businesses following this route would manually prepare their invoices in a format compliant with the IRB’s guidelines. Each of the invoicing are required to fill up manually for up to 53 fields. After preparing the invoices, they can be submitted to the myInvois portal for batch submission. The portal is for businesses to upload multiple invoices in one go.

.png)